Hiện tượng bank run và bên trong hố đen của FTX Titanbros

Perhaps most perniciously, many outlets have described what happened to FTX as a "bank run" or a "run on deposits," while Bankman-Fried has repeatedly insisted the company was simply.

Crypto Bank Run at FTX & Alameda Research

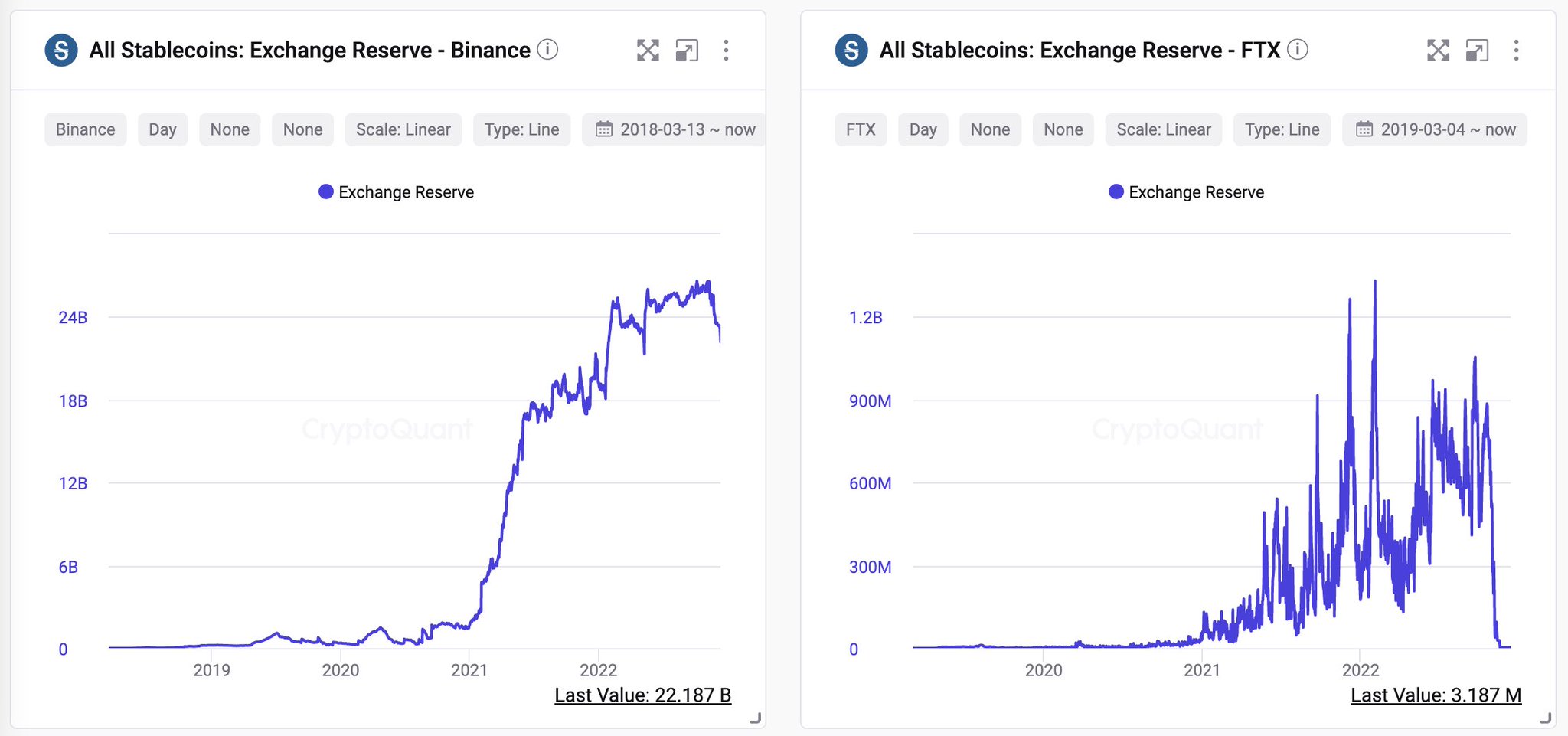

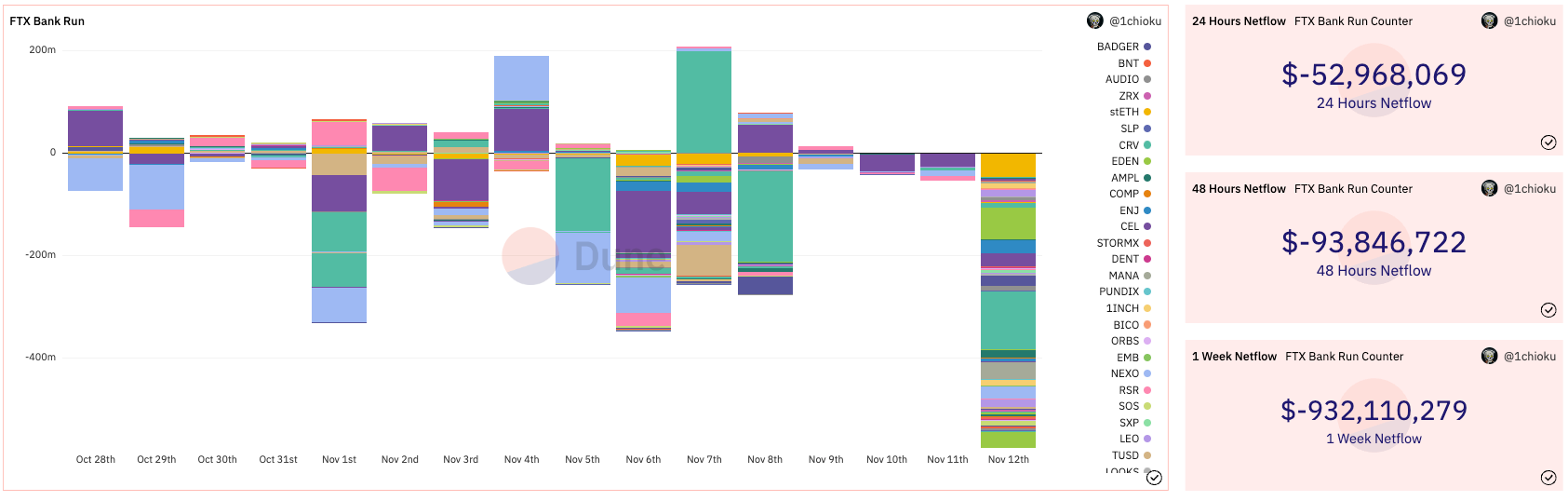

Data from on-chain analytics platform CryptoQuant put FTX's BTC balance reduction on Nov. 7 alone at -19,956 BTC. Its BTC reserves were reportedly just 7.1 BTC at the time of writing, further.

2.8B CryptoFocused Lending Firm Genesis Halts Withdrawals Fearing A

For Bitcoin holders, that means they will be owed $16,871 for each of their former coins, according to court records. The current price is more than $47,000. "The Bitcoin and Ethereum I held on.

FTX Jacquelynn Corrigan

It wasn't just a "run on the bank" that led to FTX's collapse "There was effectively a run on the bank," Bromley said, "and a leadership crisis." After Bankman-Fried's rival, Binance CEO Changpeng.

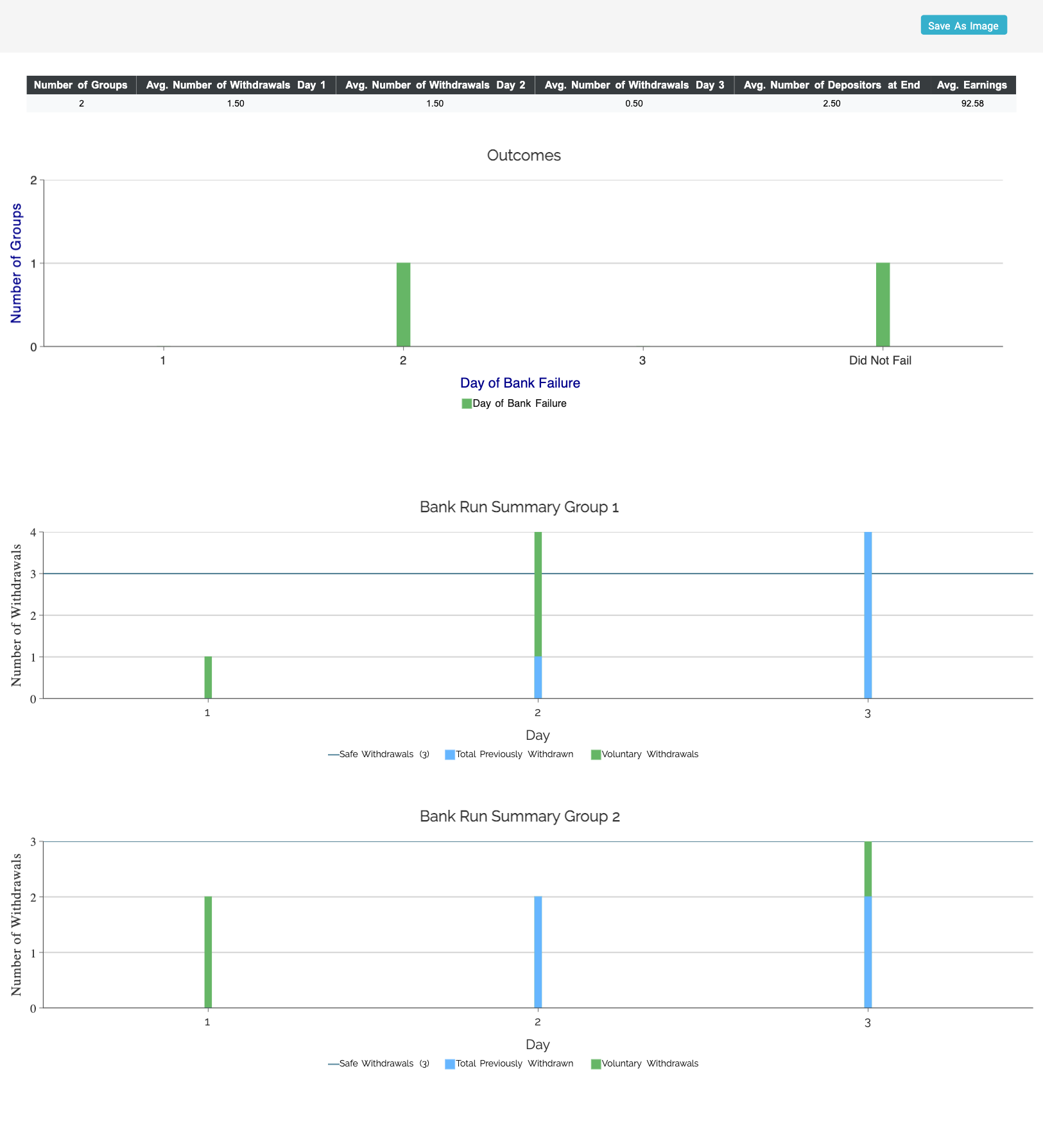

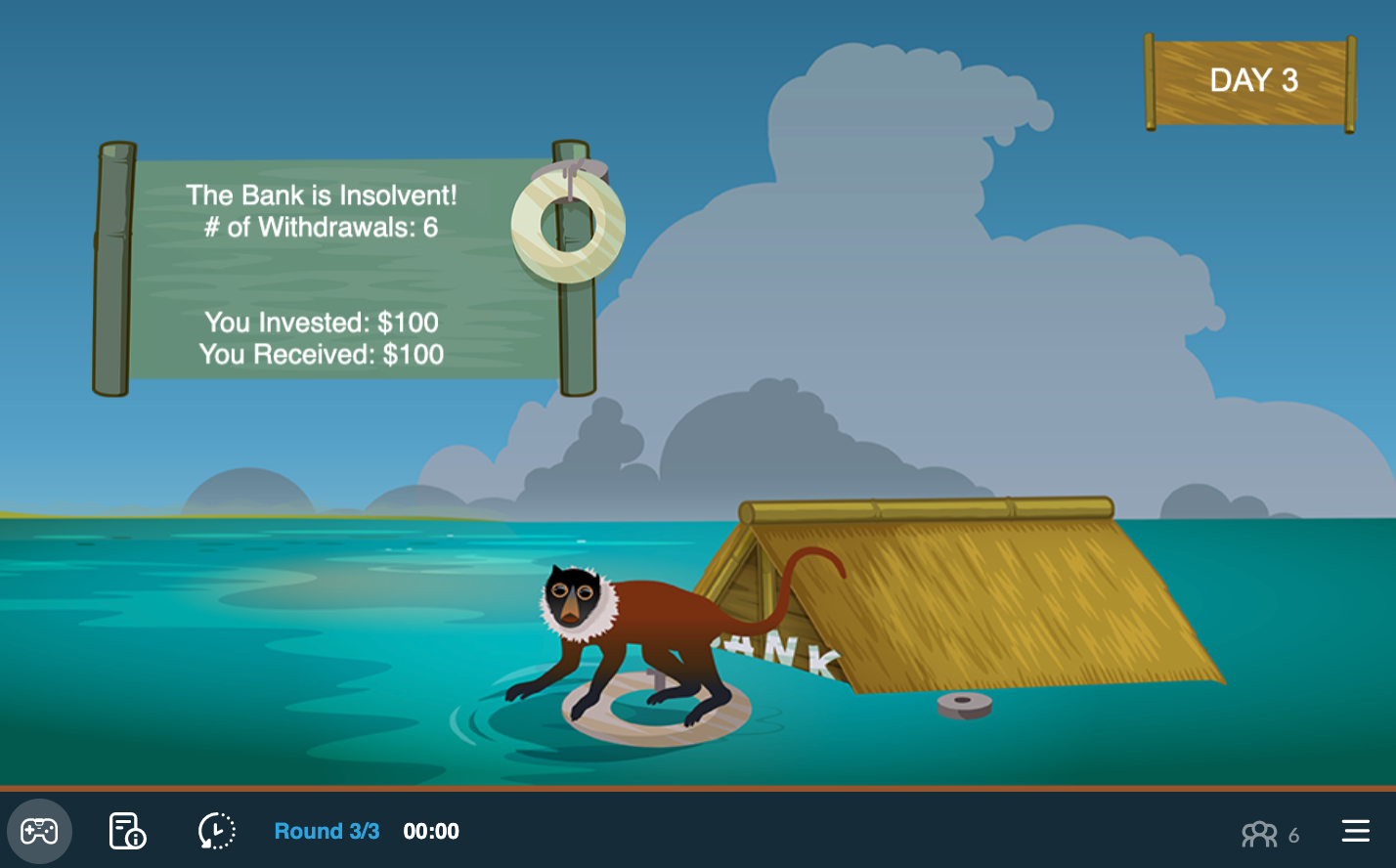

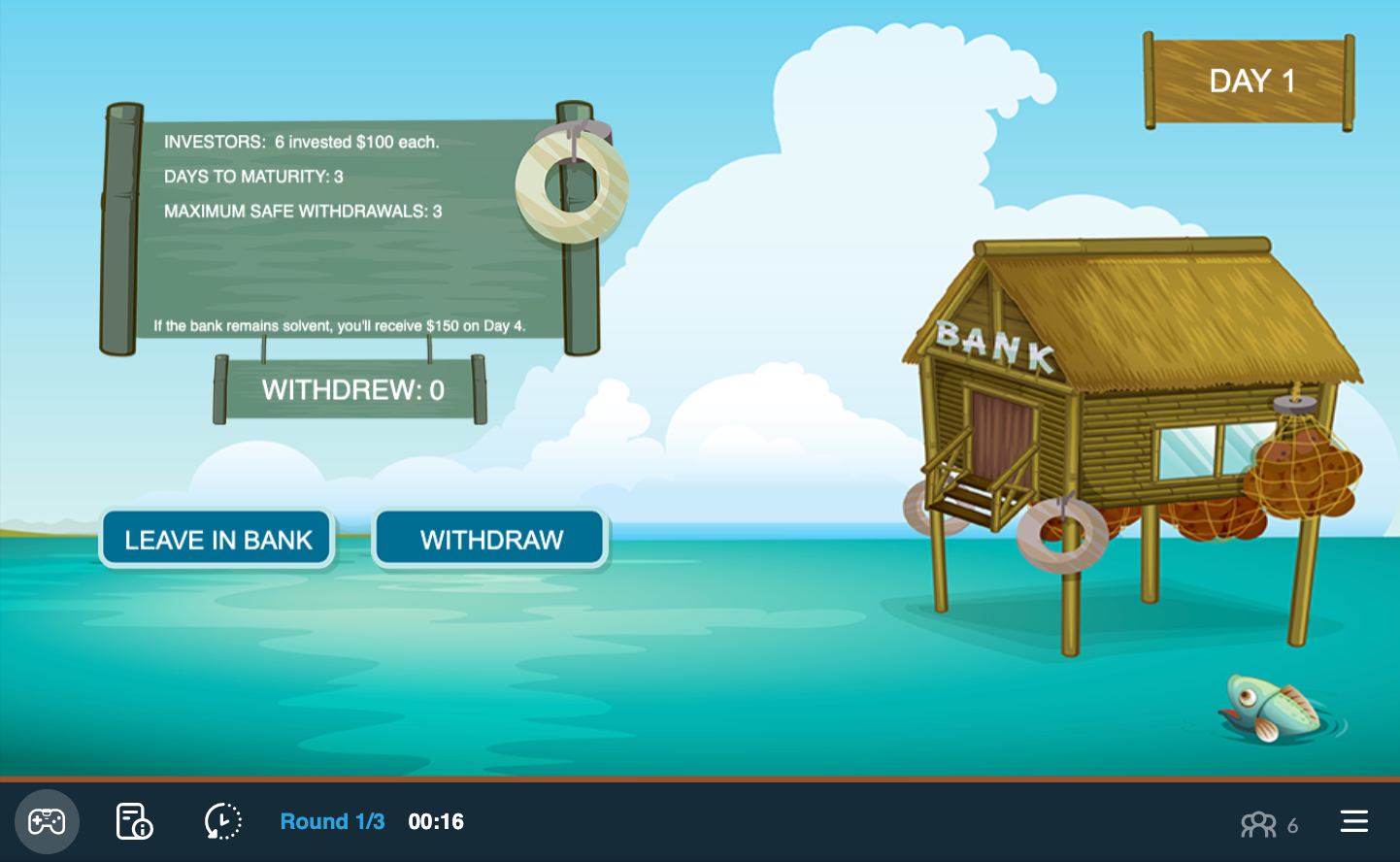

Explain a Financial Collapse with MobLab's Bank Run Game

Withdrawals from the FTX crypto exchange were so rapid and vicious that the overall balance of digital assets on the venue has tumbled 87% over the past five days, data shows. The blockchain-era.

Ki Young Ju on Twitter of stablecoin reserves on Binance

The major exit from a crypto heavyweight triggered a wider selloff, akin to a bank run, placing immense pressure on FTX to meet the sudden demand for customer withdrawals. Due to a lack of funds.

Collapsed crypto platform FTX probes 500 million hack DW 11/12/2022

Seemingly because of their known close ties, worries about Alameda's balance sheet translated into a rapidly accelerating mass exodus from FTX. The exchange saw $6 billion in withdrawals in the.

How to steal 16 billion dollars by John Cook Frontrun

The result was a run on the bank that had FTX processing more customer withdrawals than it could actually afford. FTT has since plunged in value. It reached a peak of around $50 in March before.

Explain a Financial Collapse with MobLab's Bank Run Game

This was a bank run and FTX shut down withdrawals. Then came a possible lifeline - from Binance itself. SBF asked CZ to bail out his empire, for the industry and customers' sakes.

SBF and the FTX Bank Run YouTube

The exchange successfully processed nearly $1 billion in withdrawals in the last 24 hours, quelling fears of an FTX-style bank run. Crypto exchange Binance saw over $950 million in net outflows.

FTX Dies After Bank Run & Collapse of Money Printing Scheme

Binance Seeks To End All Ties With FTX. Responding to the reports, Binance CEO Changpeng Zhao (CZ) released a tweet. According to CZ's tweet, the Binance exchange would liquidate all FTT tokens in its portfolio. In response, the CEO of Alameda Research, Caroline Ellison, offered to buy the FTT tokens at $22 per token.

FTX Bank Run! The end of Crypto? YouTube

3:21pm Nov 14, 2022. The imploding cryptocurrency trading firm FTX is now short billions of dollars after experiencing the crypto equivalent of a bank run. The exchange, formerly one of the world.

EXPLAINER What's happening at bankrupt crypto exchange FTX? Tech News

The imploding cryptocurrency trading firm FTX is now short billions of dollars after experiencing the crypto equivalent of a bank run. The exchange, formerly one of the world's largest, sought.

FTX strânge 900 de milioane de dolari întro rundă de investiții

The spectacular collapse of FTX and the downfall of its former billionaire founder Sam Bankman-Fried earlier this month resulted from the cryptocurrency equivalent of a bank run, when questions.

Explain a Financial Collapse with MobLab's Bank Run Game

A virtual bank run After Alameda's balance sheet was leaked, Changpeng "CZ'' Zhao, CEO of the crypto platform Binance, a rival of FTX, announced on Nov. 6 that his company would sell off.

Explain a Financial Collapse with MobLab's Bank Run Game

Erika Rasure. Fact checked by. Vikki Velasquez. The swift demise of cryptocurrency exchange FTX in 2022 has had damaging domino effects on the cryptocurrency industry, stoking widespread mistrust.